03 Dec Green and Transition Finance

Carbon Footprint Calculator for MICE Events in Singapore

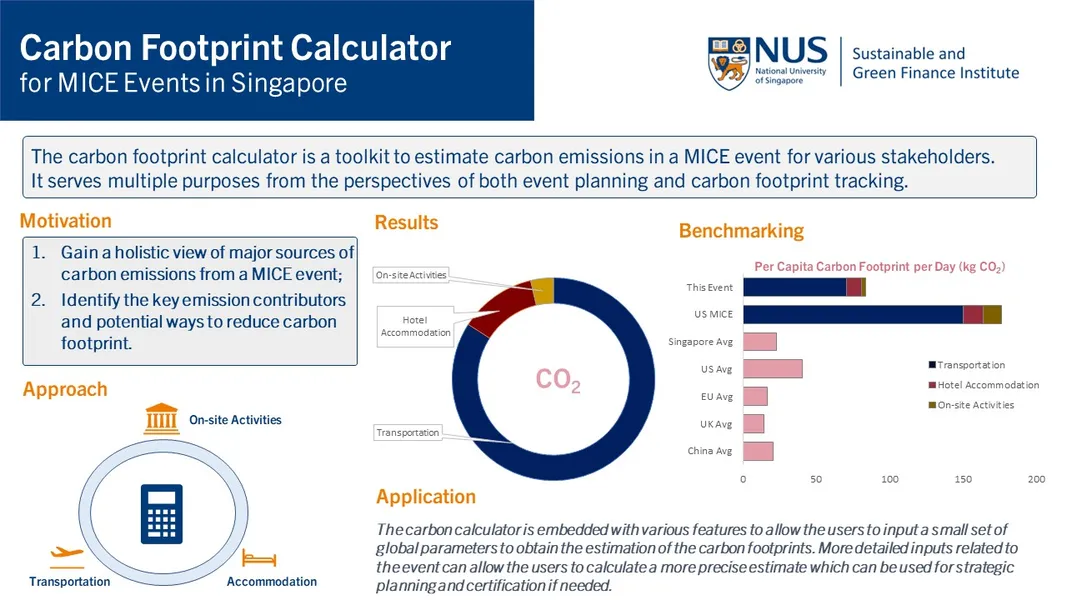

Singapore is a hub for ASEAN and international meetings, incentives, conventions and exhibitions (MICE). In 2019, the MICE industry supported more than 34,000 direct and indirect jobs with a value-add of almost S$4 billion, close to 1% of Singapore’s gross domestic product. The pro-business environment and its strategic location have made Singapore a favourable choice for holding MICE events.Climate change has made sustainability a critical consideration for large-scale gathering events. By actively tracking and estimating the carbon footprint incurred in various components of these events, organisers and participants gain a holistic understanding of carbon emissions. Consequently, event stakeholders attempt to address the imperative call for reducing carbon emissions by targeting key sources of emissions based on their relative weighting and exploring viable solutions to a greener MICE environment.

In 2022, the Singapore Tourism Board established a vision to be among the most sustainable MICE destinations in the Asia-Pacific region by 2030 or earlier. A MICE Sustainability Roadmap was established which set specific targets regarding sustainability certification for MICE venues and tracking waste and carbon emissions in Singapore.

To estimate carbon dioxide (CO2) emissions involved in different components of a MICE event, this calculator identifies critical sources of CO2 emissions spanning transportation, hotel accommodation and on-site activities.

Find out more here.

A general overview of our carbon footprint calculator project for the MICE sector.

Financing Energy Transition: Valuation of Project Impacts

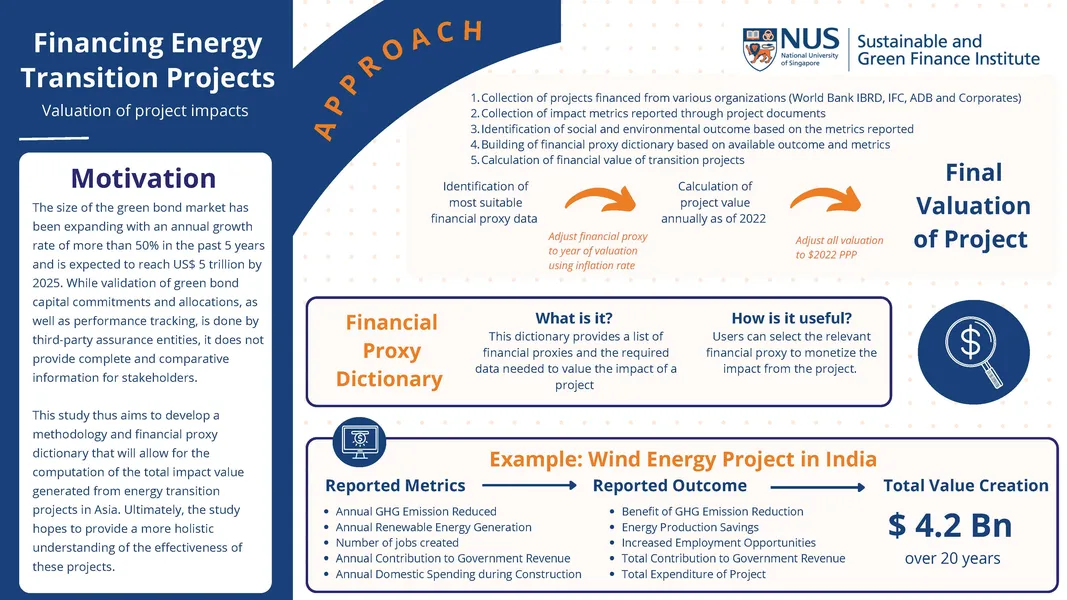

This is a study on the methodology and computation of the total impact value generated from various energy transition projects implemented in the Asia-Pacific region. The validation of these capital commitments and allocation, as well as their performance, is usually done by a third-party assurance entity. However, this process does not guarantee the complete reflection of social and environmental impacts. The use of financial proxies as a translation of impacts would facilitate a better comparison of different impacts generated by different green projects and allow for a more holistic value creation expressed in terms of the return on investment, or ROI. This will be useful for various stakeholders, such as policymakers, investors or NGOs, when making investment decisions.The key contribution of this research is to establish a holistic integrated valuation framework that facilitates the computation of the Integrated return on investment or IROI of each energy transition project. The new methodology will provide the monetisation of different impact metrics of various green projects for the ease of comparison across time and geographical locations, facilitating a more efficient investment decision process in the context of sustainable development in energy transition in different Asian countries.

Find out more here.

A general overview of our impact evaluation of energy transition investment project.

Impact Valuation: Estimating the Effects of Environmental Factors on Corporate Valuations

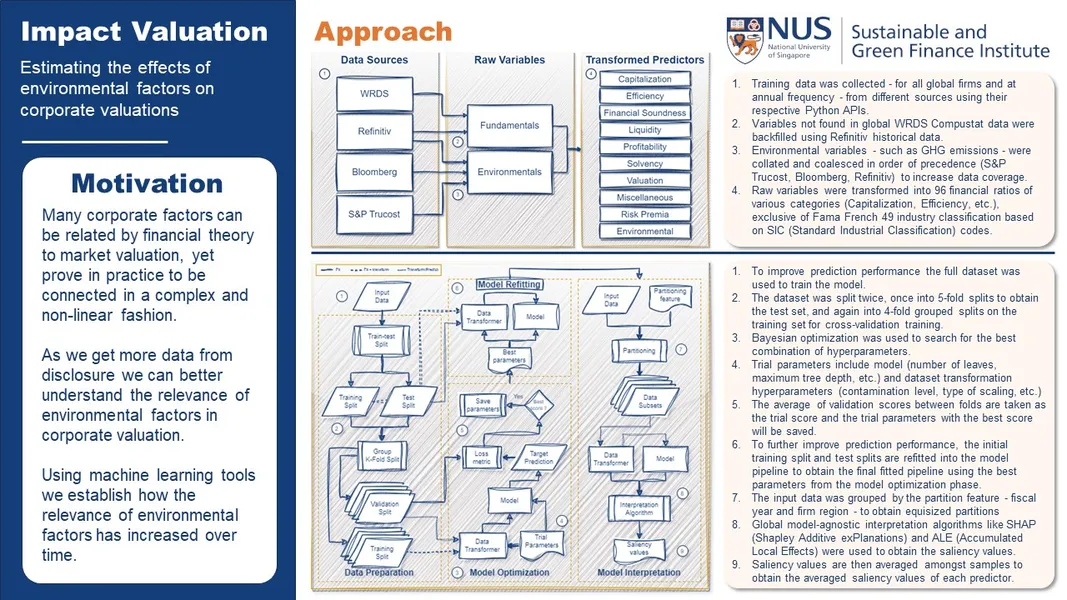

The central objective of financial analysis is accurately predicting corporate financial value and the relative factors that determine it. In this project, we place attention towards developing credible models linking corporate financial factors with stock market valuation using leading-edge machine learning (ML) techniques.ML methods offer several advantages over conventional analytical tools typically used by financial analysts. Many corporate factors (fundamentals) can be related to market valuation motivated by financial theory yet prove in practice to be connected in a nuanced, complex and non-linear fashion. For this reason, with the objective of accurately linking corporate (environmental and social) impact measures to stock market valuations, and in turn quantifying the monetary values of environmental factors for all (publicly listed) firms around the world, we cannot rely on simple linear regressions.

To better understand the changing relevance of environmental factors in corporate valuation, we have developed an impact valuation framework utilising gradient boosting machines – a decision tree-based ML framework – which provides accurate and robust predictions without over-fitting data. Such tools are particularly helpful when the underlying relationships between the factors and the predicted financial outcomes are complex or not uniquely defined by theory.

Find out more here.

A general overview of our corporate income valuation project using ML tools.