Capturing Opportunities from the Sustainability Transition

To align existing energy systems on a pathway towards net zero by 2050, the world will need to incur over US$126 trillion of additional capital expenditures from 2021 to 2050. At the same time, investments are needed to shore up aging infrastructure and physical assets to ensure that businesses remain resilient to increasing physical stresses resulting from global warming.

GIC is taking more steps to capture sustainability-related investment opportunities like these via the Sustainable Investment Fund and by creating focused teams within asset classes. In particular, the following investment platforms have recently been established to accelerate our investments in the space:

- The Climate Change Opportunities Portfolio, which is a portfolio within the Public Equities division, has been set up to deploy long-term, dedicated public equity capital towards investments aligned with the themes of climate mitigation and climate adaptation.

- The Sustainability Solutions Group, which is a dedicated team within Private Equity, seeks to deepen GIC’s exposure to early-stage energy transition opportunities.

- The Transition and Sustainable Finance Group, which is a dedicated team within Fixed Income & Multi Asset (FIMA), invests capital in sustainability-related opportunities across the FIMA universe.

Orca, the first large-scale direct air capture and storage plant in commercial operations by Climeworks, a firm that GIC's Sustainability Solutions Group has invested in.

Developing Multi-Day Energy Storage Technology

Intermittency of renewable energy has been a major challenge for the transformation of the electricity grid towards 100% clean energy. GIC has invested in Form Energy which aims to solve this issue through the development of dispatchable 100-hour multi-day energy storage technology. The company aims to bring the cost of energy storage down to around 1/10th the cost of lithium battery energy storage today.GIC's funding will enable the firm to build its first 500 MW manufacturing facility in West Virginia and deliver on over 3.5 GWh of multi-day energy storage projects announced to date with major US electric utilities, as soon as 2025.

Since we invested in 2022, the company has continued to achieve technical milestones in developing its battery technology, announced new demonstration projects with leading utilities and commenced construction of its first high-volume battery manufacturing facility.

Rendering of Form Factory 1 by Form Energy in Weirton, West Virginia.

Rendering of Form Energy battery system.

Enabling the Net Zero Transition in the Real Economy

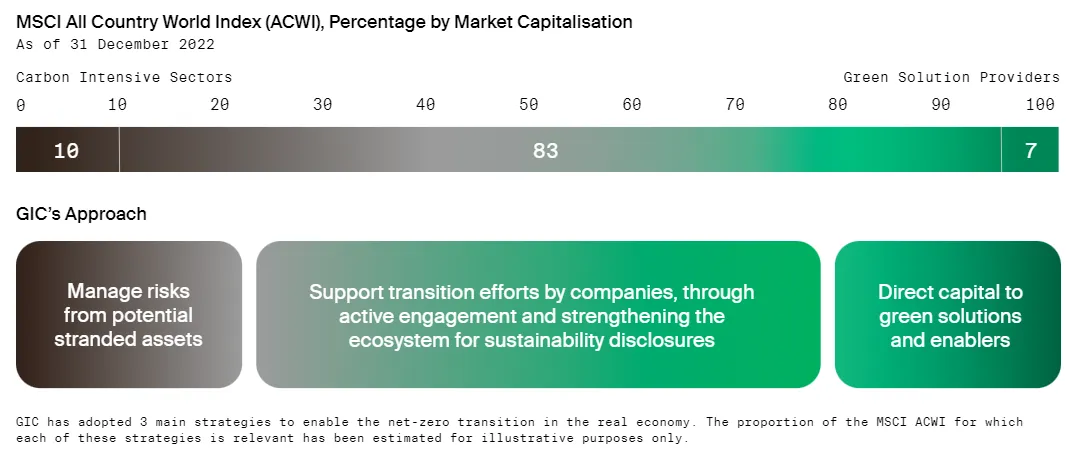

Decarbonisation pathways will differ across industries and companies. Long-term investors will need to balance supporting the capital needs of the transition and managing the investment risk to their portfolio.

GIC approaches this by dividing the investment universe into three categories:

- On one end of the spectrum are companies deriving a high percentage of revenues from renewable energy and other decarbonisation solutions. Such companies make up a small part of the MSCI All Country World Index today, a proxy for the investment universe.

- On the other end of the spectrum, companies in carbon-intensive sectors such as power utilities and transport make up about 10% of the market capitalisation of the index but contribute 40% of the overall index's weighted average carbon intensity.

- Most companies in the index are between these two ends of the spectrum with a relatively lower emissions intensity but still a critical need to transition.

GIC has adopted three strategies to enable these distinct decarbonisation journeys:

- Direct capital towards green solutions;

- Support transition efforts by companies through active engagement and strengthening the ecosystem for sustainability disclosures; and

- Manage the risks from assets that face high stranding risk due to their inability to transition.

GIC’s approach to enabling the global transition.

Integrating Climate Scenario Analysis into Investment Management

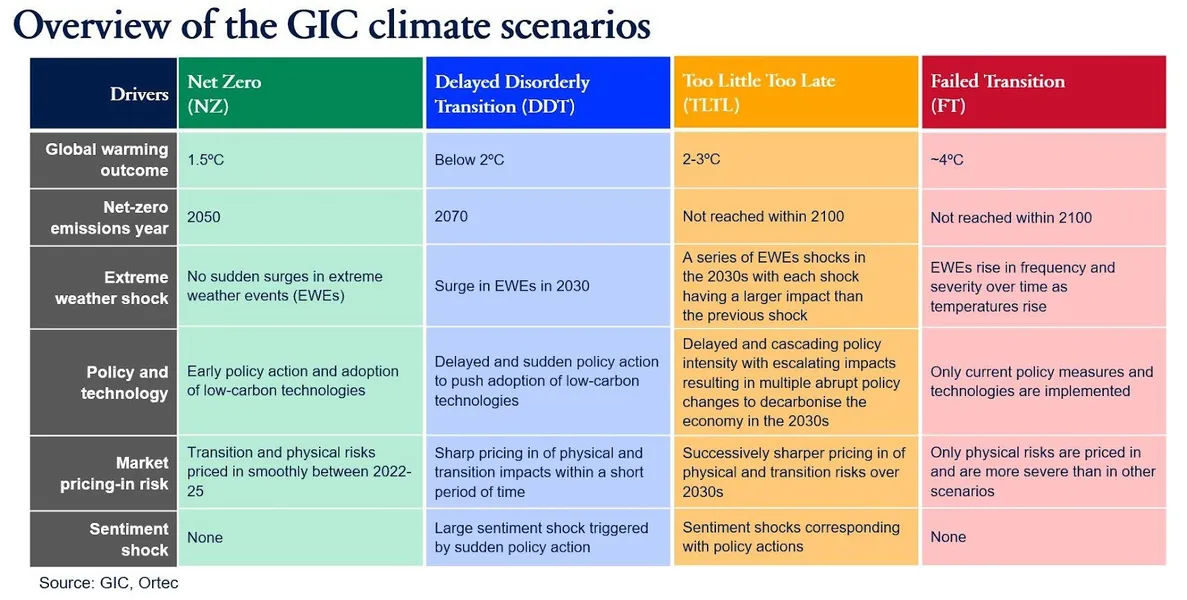

GIC partnered with Ortec Finance and Cambridge Econometrics to develop a set of climate scenarios to map out and stress test our portfolio against potential future transition pathways and create a set of climate signposts to assess the likelihood of each scenario. Such analysis provides long-term investors with a systematic approach to navigate the uncertain evolution of climate risks and their implications for macroeconomic and market conditions.Our custom scenarios go one step further compared to conventional climate scenario work. We also analyse market risks, including whether markets price in future climate risks smoothly or disruptively, and whether these would lead to sentiment shocks.

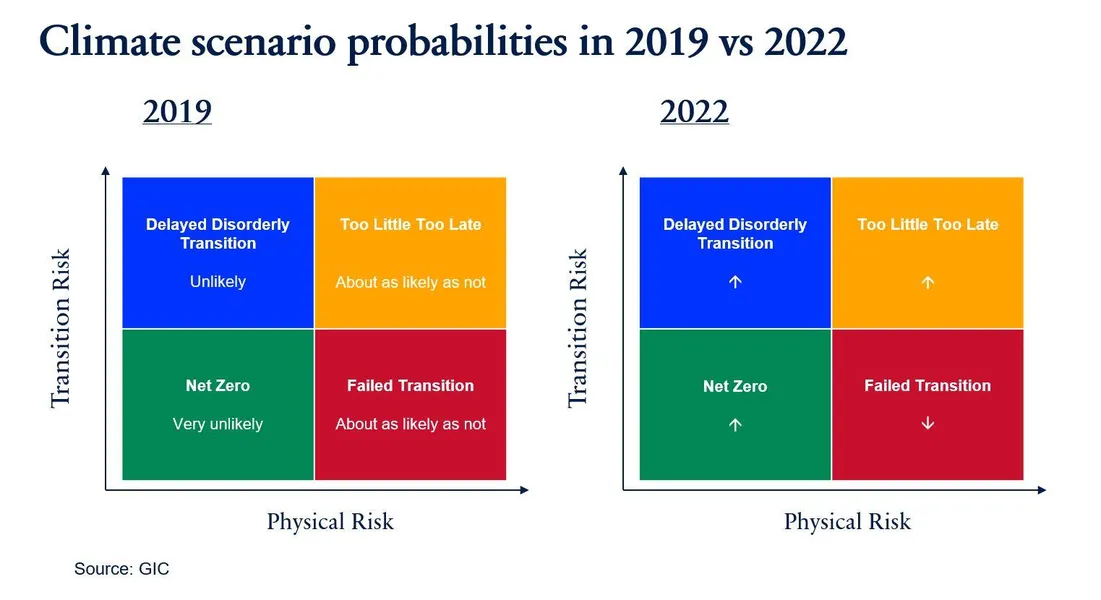

Our analysis based on the most recent scenario sets and signposts is clear: expect greater volatility, continued uncertainty, heightened transition and physical risks, and disruptive change on the horizon. Investors must take a balanced approach to managing both transition and physical risks given the considerable uncertainty over which scenario would eventually materalise, and prepare for market beta to be likely negatively affected by climate-related drivers, especially physical risks, over the long term.

Find out more here.

Overview of GIC’s climate scenarios.

Climate scenario probabilities in 2019 compared to 2022, as reflected in the GIC Climate Signposts.