Call the 24/7 ScamShield Helpline at 1799 if you are unsure if something is a scam.

HTML

HTML

HTML

UOB

UOB is a leading bank in Asia. It operates through its head office in Singapore and banking subsidiaries in China, Indonesia, Malaysia, Thailand and Vietnam, with a global network in 19 markets in Asia Pacific, Europe and North America. Since 1935, UOB has grown organically and through strategic acquisitions. UOB is rated among the world’s top banks: Aa1 by Moody’s Investors Service and AA- by both S&P Global Ratings and Fitch Ratings.

For nine decades, UOB has created long-term value by staying relevant through its enterprising spirit and doing right by its customers. UOB is focused on building the future of ASEAN – for the people and businesses within, and connecting with, ASEAN.

Simplifying access to sustainable finance for SMEs

UOB is committed to ensuring that small- and medium-sized enterprises (SMEs) across ASEAN are not left behind in their transition to a low-carbon, climate-resilient economy. From UOB Sustainability Compass, a quick, online tool that helps SMEs obtain clear, actionable steps in a customised report for their sustainability journey, to tailored sustainable finance frameworks and a suite of U-Series solutions that are aligned to internationally-recognised standards, principles and guidelines, we make sustainable financing inclusive and accessible for SMEs looking to build resilient businesses.

In 2024, UOB launched the SAGE Programme – in collaboration with Enterprise Singapore – for SMEs to apply for sustainability-linked financing more easily. Companies that achieve pre-agreed sustainability performance targets can enjoy preferential loan rates and defray up to 85 per cent of the costs of various sustainability-related services.

Driving sustainable financing through the climate-nature nexus

UOB believes that addressing nature-related risks and opportunities is an urgent matter. In 2024, UOB committed to be an early adopter of the Taskforce for Nature-Related Financial Disclosures (TNFD). As a commercial bank with the power to mobilise private capital, UOB seeks to play its role in contributing to and supporting activities that align with the Kunming-Montreal Global Biodiversity Framework’s vision of halting and reversing biodiversity loss by 2030 and living in harmony with nature by 2050.

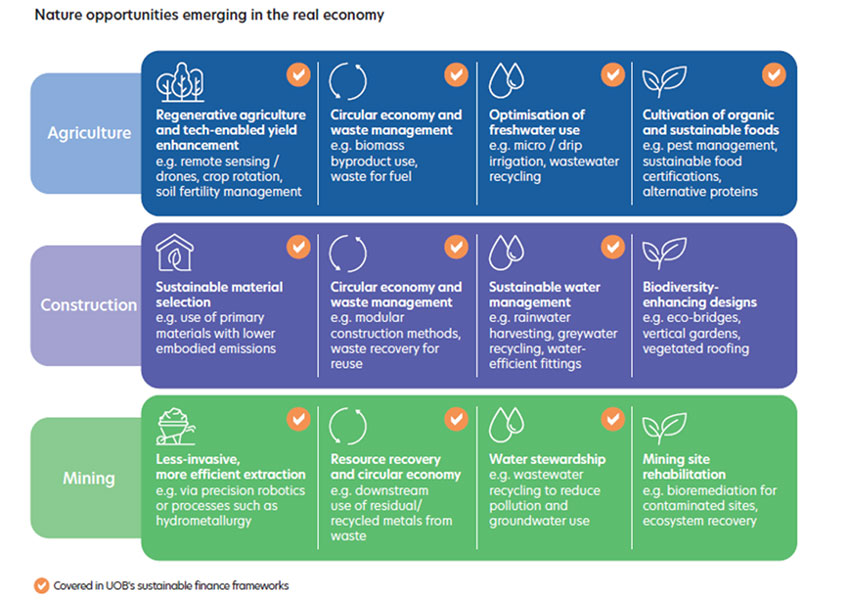

Some of the activities that preserve or restore nature are activities that UOB has long been financing as part of its climate strategy and commitments. UOB’s sustainable finance frameworks already include several nature elements, though traditionally they have been classified as green financing rather than nature or nature-related financing. About 60 per cent of UOB’s sustainable financing portfolio falls within the climate-nature nexus (based on an internal assessment).

Powering solar development in the region

UOB’s Sustainable Cities Framework supports companies in the development of green assets, projects and activities relating to sustainable cities. In 2021, UOB extended a green loan under this framework to support Ragawang Power Sdn Bhd on the development of a 50 megawatt Large Scale Solar (LSS) project in Pekan, Pahang in Malaysia. The project is under the LSS4 initiative, a national programme launched by the Ministry of Energy Transition and Water Transformation of Malaysia, aimed at delivering one gigawatt of solar capacity to the Malaysian grid.

The project was successfully completed and commissioned in January 2024. It now generates approximately 107 gigawatt-hours of energy, equivalent to 68,550 tonnes of carbon dioxide-equivalent in emissions avoided. This translates to more than 15,000 passenger vehicles off the road in one year or more than 1.1 million tree seedlings grown for 10 years.

Back

Back